In today’s fast-moving digital economy, a new model is gaining serious traction:

Renting a legally registered company instead of registering or maintaining your own.

It’s not just a workaround—it’s becoming a mainstream strategy for founders who want speed, flexibility, and minimal risk. And it's part of a larger shift toward what experts are calling the “company sharing economy.” (StartUs)

Let’s explore why this shift is happening, who it’s for, and how you can use it to your advantage.

Why Traditional Incorporation Slows Down High-Volume Businesses

Once your company starts moving serious revenue, the old way of doing things becomes a bottleneck.

Traditional incorporation means:

Full legal exposure in your personal or home jurisdiction

Endless compliance cycles eating into profit and focus

Tax liabilities that scale with your success

Delays in verification, banking, and cross-border approvals

For established founders running global operations, these layers don’t just slow you down—they tie up liquidity, block partnerships, and limit how fast you can enter new markets.

That’s why top-performing businesses are now skipping the paperwork grind and connecting to existing, compliant entities through a rental model—so they can expand, transact, and operate globally in days, not months.

Enter the “Company Sharing” Economy

The same way we now share cars, offices, and tools, entrepreneurs are beginning to share companies.

According to a Forbes feature, freelancers and solo founders increasingly prefer renting companies over owning them. It allows them to focus on delivering value rather than worrying about taxes, registration, and paperwork. (Forbes)

Platforms like Winglio helped pioneer this model, offering full access to a legal structure for invoicing, payments, and compliance—without needing to own the entity. You pay only when you earn, with a flexible partnership fee (e.g., 6.6% of income), aligning cost with business performance. (StartUs)

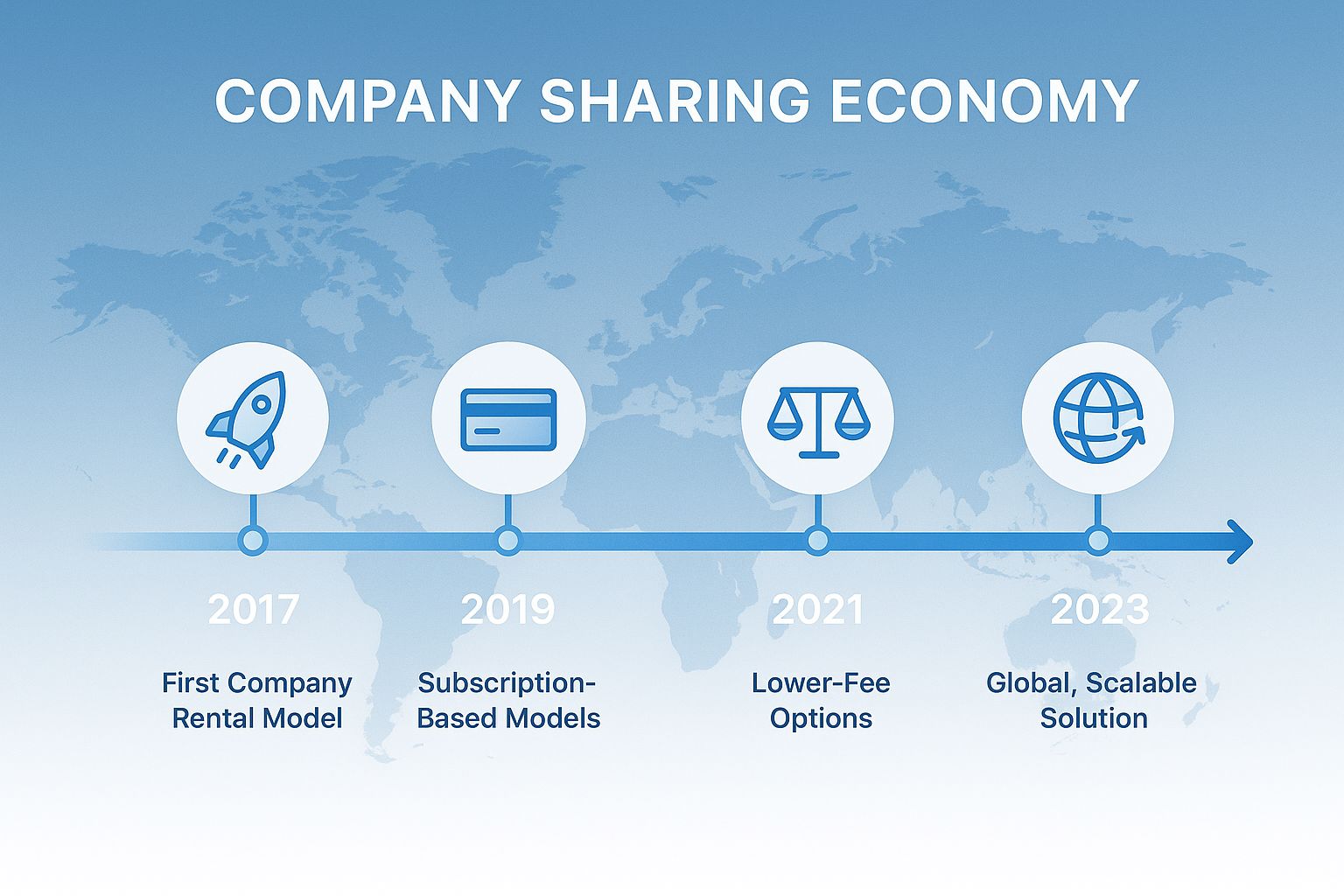

Since then, the market has evolved. Better offers have emerged—some charging a low monthly subscription with a reduced fee, others eliminating subscriptions entirely and lowering the partnership fee. This competition has created more accessible, founder-friendly models for company rental than ever before.

Diagram of milestones of company sharing models

The Real Freedom Isn’t in Owning a Company

It may look impressive to own a company — your name on the documents, your logo on the registry. But for many founders, that “ownership” comes with more liability than freedom.

When you own a company outright, you own the risk:

You become legally and financially exposed across jurisdictions

You inherit tax obligations that grow with your revenue

You’re tied to compliance cycles, audits, and endless filings

You’re often limited to a narrow set of banking options within that jurisdiction — reducing flexibility and access to better payment rails

The truth?

The smartest founders today understand that the real asset isn’t the shell — it’s the Intellectual Property. Protecting and monetizing what you create matters far more than holding the entity that invoices it.

That’s why many high-performing entrepreneurs now rent existing, compliant companies instead. They get:

✅ Instant legal and banking infrastructure

✅ Faster market access

✅ Minimal exposure to tax and liability risks

✅ Wider banking and payment coverage across borders

✅ Full privacy and name protection

✅ Full focus on scaling and safeguarding their IP

Owning a company might look sexy on paper — but renting one lets you move, earn, and protect your work without the baggage.

What to Ask Before Renting a Company

To avoid legal or financial surprises, be sure to vet the following:

Contractual clarity: Are your rights, responsibilities, and exit paths clearly outlined?

Proof of legitimacy: Request certificates, registrations, and compliance documents.

Transparent fees: Know all the costs—no hidden markups or transaction charges.

Access to tools: Can you use Stripe, PayPal, or local bank accounts seamlessly?

Scalability: Does the model adapt as you grow—or penalize success?

The Shift After Adopting the Model

The business stops revolving around maintaining a structure, and starts revolving around leveraging one.

Suddenly, opening accounts doesn’t take weeks. You gain instant access to multi-currency banking, local IBANs, and payment rails that actually work for global business.

Accepting cards through Stripe, PayPal, or regional processors becomes seamless instead of stressful. Cross-border transfers clear faster, suppliers get paid without red flags, and expansion into new markets no longer triggers a mountain of paperwork.

The same move often unlocks friendlier tax environments, allowing founders to reinvest more and compound growth faster — instead of losing margin to inefficiencies and filings.

The result? A structure that moves with your business — not against it.

A New Option: Remoove's Plug & Play Company

One standout in this space is Remoove’s Plug & Play Company, built specifically for digital-first entrepreneurs.

Their model offers global infrastructure with:

A competitive partnership fee that decreases as you scale

Seamless access to Top-tier fintech partners (online banks & payment processors)

A compliance-ready company structure you can operate through from day one

Whether you provide services, broker deals, consult, or run any kind of digital-first business, Remoove’s setup is built for simplicity and speed—without ever compromising legitimacy.

Ready to Launch Without the Legal Headache?

If you're looking to go global, scale faster, and ditch the bureaucracy, Remoove's Plug & Play Company is your next strategic move.

✅ Set up in days, not months

✅ Eliminate legal complexity

✅ Keep your focus on growth, not admin

Click below to explore Remoove’s Plug & Play Company and start building without borders.

Final Thoughts

The idea of “company sharing” isn’t just a clever loophole—it’s part of a broader rethinking of how infrastructure is accessed in the digital age. As Forbes put it, renting a company is becoming the new smart move, and increasingly, the entrepreneur’s best-kept secret.

For founders chasing global markets, speed to revenue, and agile infrastructure, renting a company might be the ultimate growth hack.

Want more high-leverage strategies like this?

Stick around for next week’s edition. And follow @thefreedom.brief on Instagram for daily micro-insights and strategic tips for digital business builders.

Paid Placement — The Global Vault by Remoove