What’s Changing:

UK financial regulators — led by the Financial Conduct Authority (FCA) and the Payment Systems Regulator (PSR) — are changing the game for embedded finance and B2B payment facilitation. They're expanding regulatory supervision over these fast-growing areas of fintech to bring more clarity, consistency, and consumer protection.

Embedded finance — think payments, lending, or digital wallets built into non-financial apps and platforms — has exploded in the UK. Now, with the government consolidating oversight under the FCA, the goal is to create a more streamlined and supportive environment for innovation.

🧠 What Exactly Is Being Regulated?

Embedded Finance Models: Everything from marketplaces offering Buy Now, Pay Later (BNPL), to SaaS tools embedding credit or payment flows.

B2B Payment Facilitation: Platforms acting as intermediaries for business payments are now squarely on the regulatory radar.

Simplified Oversight: The FCA will gradually take over more payment-related regulation, streamlining governance that was previously split across bodies.

Bottom line? If your business touches financial transactions in any way, you’ll likely fall under these new scopes of supervision.

📌 Why This Matters to Digital & Online Businesses

1. More Compliance Responsibility

Whether you're embedding payments, wallets, or BNPL through partners or in-house solutions, regulators will expect tighter controls, reporting, and accountability.

2. Higher Operational Expectations

Embedded finance is no longer a “nice-to-have” feature—it’s a regulated financial service. That means your platform needs to ensure it’s working with licensed partners and has risk, identity, and data protections in place.

3. Clarity Reduces Risk

Regulatory uncertainty can stall innovation. Clear rules reduce ambiguity and help you plan ahead with confidence.

4. First Movers Win

The businesses that get ahead of these rules will be the ones that win trust, attract regulated partners, and grow faster.

…. so what can be done?

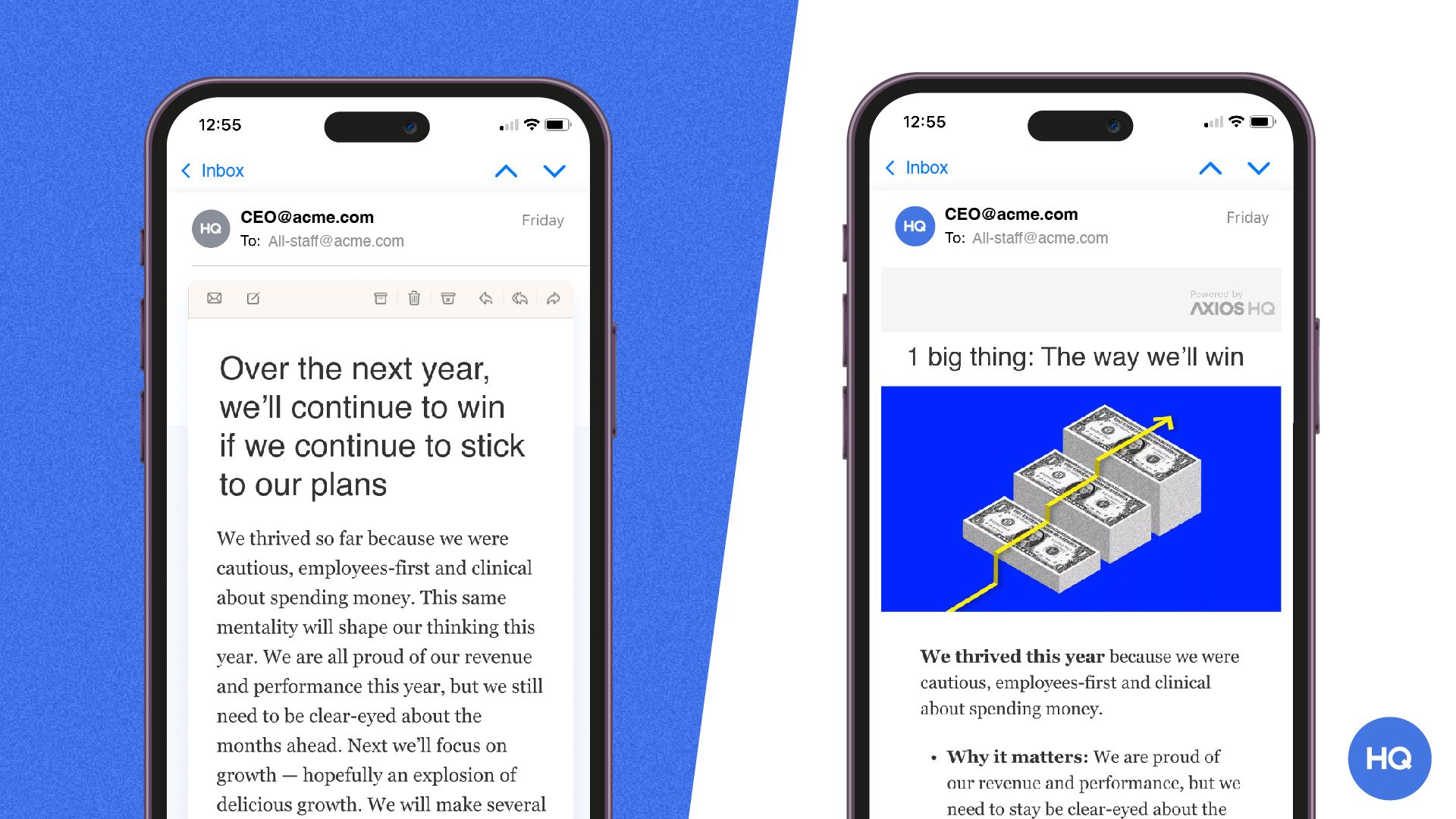

Attention is scarce. Learn how to earn it.

Every leader faces the same challenge: getting people to actually absorb what you're saying - in a world of overflowing inboxes, half-read Slacks, and meetings about meetings.

Smart Brevity is the methodology Axios HQ built to solve this. It's a system for communicating with clarity, respect, and precision — whether you're writing to your board, your team, or your entire organization.

Join our free 60-minute Open House to learn how it works and see it in action.

Runs monthly - grab a spot that works for you.

🚀 What Smart Businesses Should Do Now

✅ 1. Audit Your Embedded Finance Stack

Map every financial feature in your product. Who provides it? Are they licensed? Would they be affected by expanded oversight?

Action: Run a partner and product audit. Understand your exposure.

✅ 2. Build Compliance Into Your Workflow

Don't wait for a regulator to knock. Start integrating AML, KYC, and fraud detection into your roadmap now.

Action: Make compliance part of your quarterly product planning.

✅ 3. Choose the Right Partners

Not all fintech vendors are ready for what's coming. Work with partners that are FCA-registered or moving in that direction.

Action: Vet your fintech stack for long-term alignment with UK rules.

✅ 4. Turn Compliance Into a Trust Signal

Use your regulatory readiness as a competitive advantage. Customers trust compliant platforms more.

Action: Show off your compliance posture in marketing, onboarding, and investor decks.

📅 What’s Next?

This isn't a crackdown—it's a framework for the future. The UK is setting the stage for sustainable fintech growth. For digital-first founders, this means:

Innovation with clearer boundaries

Compliance as a growth lever

More scalable, resilient financial products

If you get ahead now, you won’t just avoid friction. You’ll open the door to more ambitious opportunities.

📌 Final Thought

Embedded finance is here to stay. Regulation is catching up. Treat compliance as a feature—not a burden—and you'll build a business that's ready to scale, partner, and thrive.

Stick with us for more practical insights like this, and follow @thefreedom.brief on Instagram for daily updates and digital growth tips.

Paid Placement — The Global Vault by Remoove